Watch our training videos.

Crush your banking interviews.

Hit the ground running in your new finance job.

Don’t want to read it all? Jump straight down to our financial modeling training video plans immediately.

Do you remember first learning how to drive?

When I took driver’s ed, the textbook was over 150 pages long. It covered:

- mirrors, seat belts, child safety harnesses, airbags, speed limits, signaling, horns, headlights, emergency lights, text messaging, cell phones

- u-turns, traffic lights, signs, right-of-way, lane control, line colors, passing / carpool / bicycle lanes, following distances, merging in and out of traffic

- crosswalks, intersections, roundabouts, parallel / colored curb parking, traffic tickets, double fine zones, vehicle registration, organ donation

It was a ton of info. It all made sense in isolation.

But when it came time to actually get behind the wheel, my head was swimming and I couldn’t keep it all straight.

Alls I wanted to know was: What do I ACTUALLY need to know RIGHT NOW to operate this vehicle?

My driving instructor sat in the passenger seat and made it way simpler.

Buckle up. Check your mirrors.

Brake. Shift to reverse. Back out slowly.

Brake. Shift to drive. Turn the wheel.

Drive.

When you’re learning the basics, all you need to know is: when to brake, when to drive, how to steer.

That’s it.

Keep it simple.

All that crap about colored curb parking, emergency lights, and organ donations doesn’t matter.

I’m not saying they’re never important. Just not when you’re starting out, trying to get your foot in the door.

WHAT’S THIS GOT TO DO WITH FINANCIAL MODELING?

Well, getting good at financial modeling works the same way.

Maybe you’re prepping for investment banking or corporate finance interviews.

Or maybe you’re getting ready to start a new banking job and you want to brush up and get a head start on financial modeling and DCF skills to hit the ground running.

One essential skill to master is building a fully integrated 3-statement financial model and DCF valuation in Excel.

By the time I joined the Corporate Finance Practice at McKinsey & Company, and later joined the global private equity firm Huntsman Gay Global Capital, I could build these models in my sleep.

But when I first learned to do this — man, I struggled.

I read a ton of theory. But after literally four or five finance books, I STILL didn’t know exactly how to put it all into practice.

Why?

Because in school and books, you learn abstract theory like: Fama-French three-factor model, Dividend Discount Model, Capital Asset Pricing Model, Security-Market Line, Weighted Average Cost of Capital.

They all make sense in isolation.

But how do you actually put them all together when it’s time to crank out an Excel model RIGHT NOW? Like, literally after you open up Excel, what’s the very first step? And the second? And the third?

Well, guess what?

Almost none of that academic finance theory actually matters. Not in your interviews, and certainly not on the job — at least, not in the way you might think. It never comes up in client meetings or presentations.

Don’t get me wrong. You DO need to know how to do things like evaluate goodwill, amortize intangible assets, recognize deferred revenue, and compute WACC / terminal value. But the way the pros actually construct 3-statement models and DCFs is far more straightforward than the way academics think about it.

Bankers don’t debate the tradeoffs of Fama-French vs. CAPM vs. DDM.

They don’t agonize over calculating Beta.

It’s not that these aren’t interesting. They just don’t ultimately drive and create value for companies. That’s why bankers don’t spend time fussing over academic details.

Think about it this way. Not counting Wharton grads — who presumably learn finance theory in school until their noses bleed — a huge contingent of banking analysts come from Ivy League or similar schools that DON’T EVEN HAVE business classes where you can learn finance theory.

Harvard. Yale. Princeton. Stanford. MIT. Columbia. Dartmouth. Amherst. Williams. Duke.

These places don’t have fancy college classes on finance and valuation. Yet undergrads there routinely get recruited for analyst jobs at banks.

And it’s not because they magically learn the canon of financial theory two months before their interviews. It’s because there are only a few key finance concepts that really matter; everything else is just common sense and business judgment.

So you can save a lot of time prepping for your interviews by just focusing your energy on the few concepts that really matter.

Ironically, at the same time, even when colleges DO have undergrad business programs, they usually do NOT teach skills that are actually useful: like how to parse a public company 10-K or how to interpret a debt footnote.

But you WILL need to be able to do these quickly, efficiently, and accurately to succeed in banking and corporate finance interviews — as well as on the job.

That’s where this course comes in.

WHAT WILL OUR FINANCIAL MODELING COURSE TEACH YOU?

We cut through all the excess theory and focus only on what really matters.

Our video training course teaches you step-by-step how to build the kind of fully integrated 3-statement financial model in Excel that you will do EVERY DAY on the job as an investment banker or corporate finance professional.

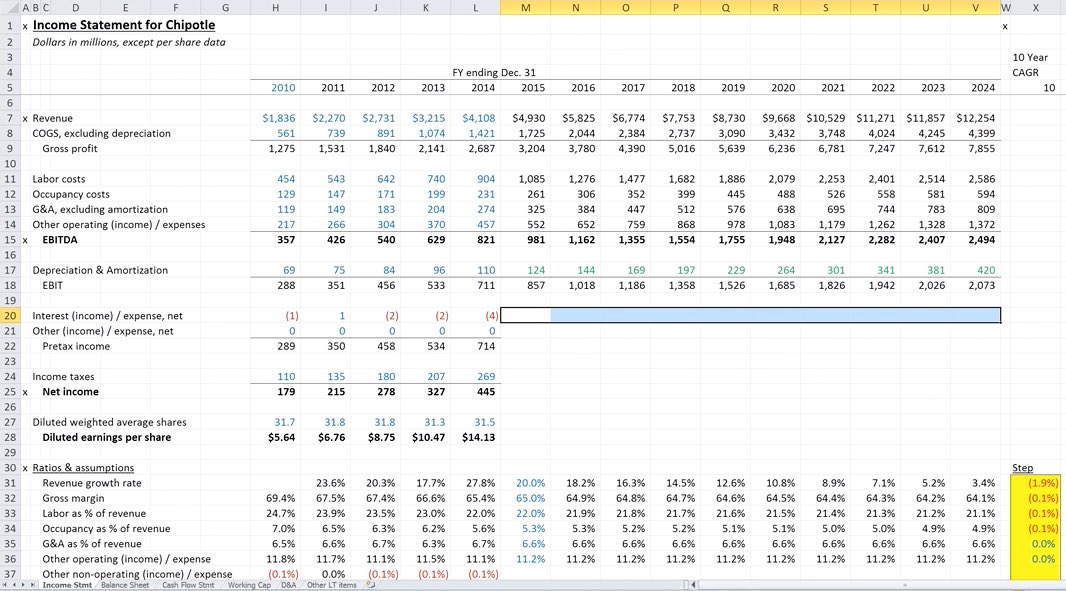

We use a well-known public company for our case study: Chipotle Mexican Grill.

We don’t dwell on abstract financial theory. We focus only on practical concepts and skills you need to:

- Analyze a public company 10-K

- Efficiently extract all the information you need to build a 3-statement model

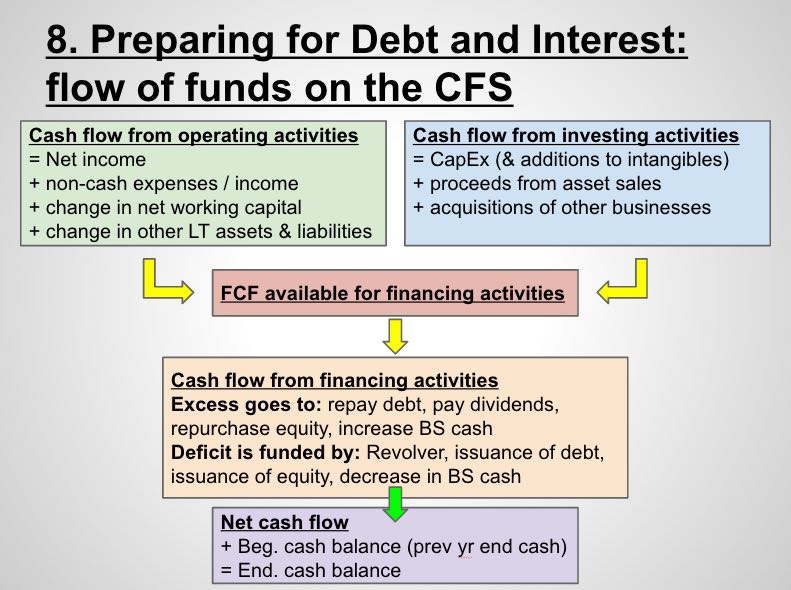

- Intuitively understand how the core statements link to the supporting schedules

- Rapidly and accurately model historicals, supporting schedules, and projections in Excel

- Troubleshoot your model accurately and quickly when accounts don’t balance or reconcile

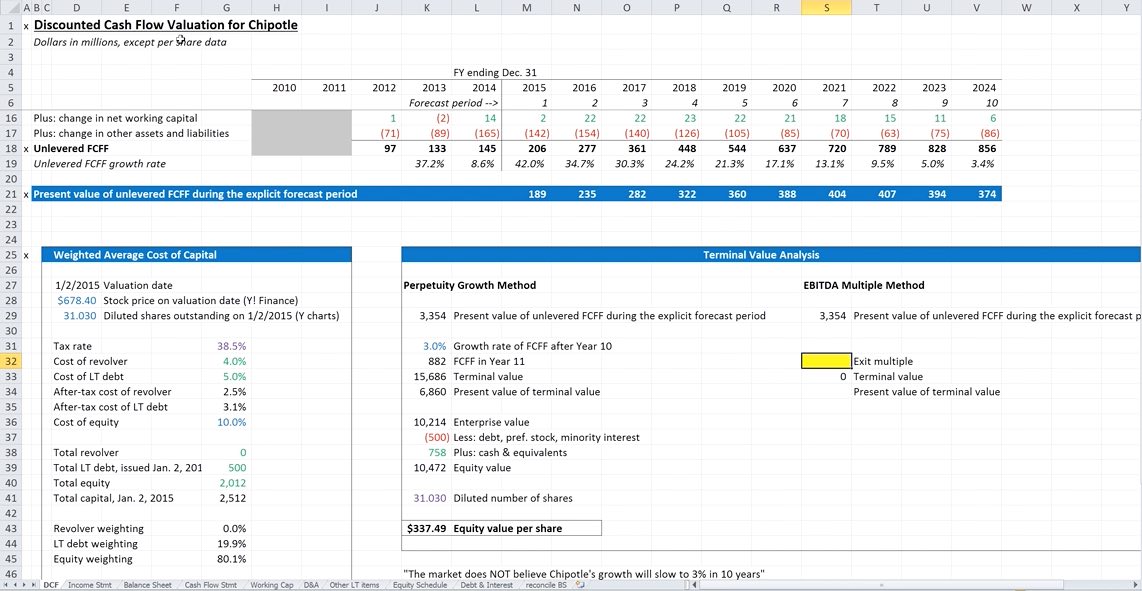

- Understand the key concepts you need related to depreciation & amortization, goodwill, circularity, unlevered vs. levered cash flows, terminal value, weighted average cost of capital, and enterprise vs. equity value

For Plus and Pro customers, we also show you how to accurately and efficiently set up a DCF valuation analysis using both perpetuity growth and EBITDA multiple methods.

Here’s a sample video from our course, to give you an idea of how we teach and what we focus on:

We get down to business and teach you only the useful stuff — and at lower cost than our competitors.

With our training videos, you learn at your own pace and you can watch our examples as many times as you need to master financial modeling.

It’s the perfect solution for fast learners who have no prior finance experience, as well as experienced candidates who simply want a modeling refresher.

WHAT HAVE OTHER CUSTOMERS SAID ABOUT THE TRAINING VIDEOS?

“Your video course was a great refresher. I already had strong accounting skills, but I was rusty on finance, valuation, and corporate strategy since I learned most of that in school several years ago. Your financial modeling videos were invaluable for me to quickly get back up to speed over a couple weekends. I successfully made a switch and got an investment banking offer with Goldman. My hours are longer now but the job is a lot more exciting!”

– Investment Banking Associate at Goldman Sachs, former “Big 4” accounting associate

“This financial modeling course was excellent and detailed. More than any other resource I’ve seen, it helped me get the intuition behind how the main financial statements (balance sheet, income statement, cash flow statement) interact with the supplemental schedules. The flow diagrams at each step in your videos were insanely helpful. Also, the parts where you showed how to systematically troubleshoot an Excel model that doesn’t balance helped me strengthen my accounting instincts. I came from a non-target school for recruiting, but I definitely think your inside perspective and tips helped me stand out. Thanks for putting this together!!”

– FIG Investment Banking Analyst at Morgan Stanley, graduate of a large public state university

“I got the call inviting me to interview on short notice so I didn’t have much time to prepare. Andrew’s video prep course cut to the chase so I could focus on the most essential aspects for doing well in my banking interview. The video modules point to exactly the parts you need to know to quickly set up and analyze financial statements and build accurate valuations. Andrew simplifies explanations and shows exactly where to hunt down data efficiently in 10ks and how to interpret them, which is so helpful. Highly recommend this resource if you need a no fluff crash course on modeling and valuation.”

– Consumer & Retail Investment Banking Analyst at Bank of America Merrill Lynch

“The video lessons contain a solid framework for learning and applying the accounting and valuation skills needed to actually be an investment banker. It takes the knowledge from academic textbooks and shows their real world application. That was critical for me in getting ready for IBD interviews. I ultimately received several offers. Thank you guys for creating these video lessons.”

– Restructuring Analyst at Lazard, graduate of Northwestern University

OK, SWEET. HOW DO I SIGN UP?

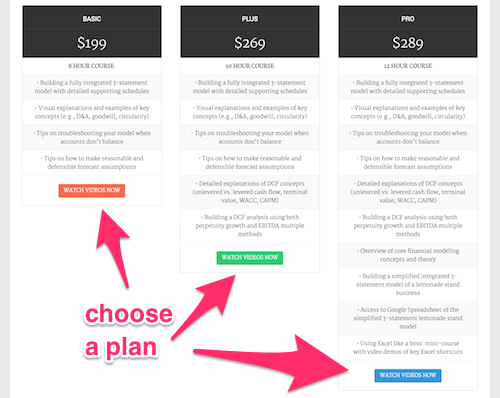

First, you’ll scroll down to the bottom and choose the plan you want: Basic, Plus, or Pro.

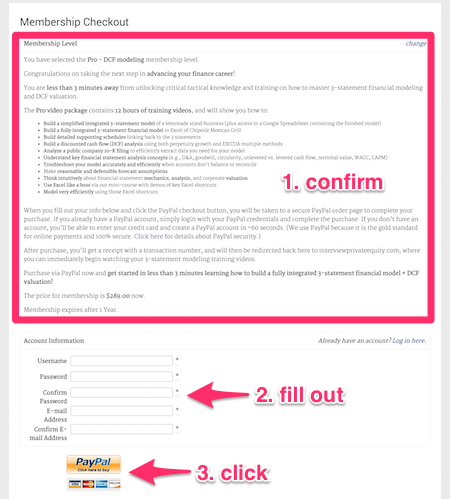

On the next page, you’ll confirm the details of your selection and fill in your account information, like shown below. Click the buy button.

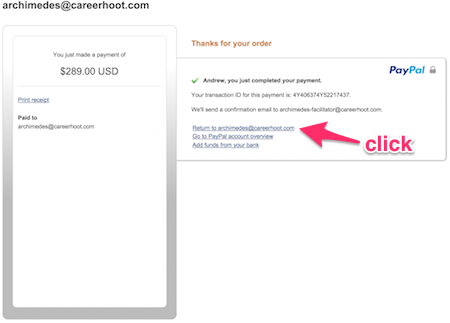

After completing your purchase, click “Return to [email protected]” (which FYI is the domain account I use to run this website).

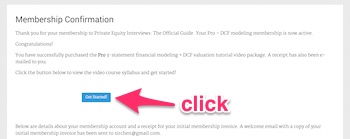

Finally, click the “Get Started” button on the purchase confirmation page, and you’ll get instant access to the library of training videos you purchased.

Here are a few PREVIEW SCREENSHOTS of our training videos:

All our training video packages grant access to all videos in that package for 1 full year.

We also offer discount combo packages when you buy both our DCF + LBO training video courses together.

Still not sure? You can check out our first two financial modeling training videos for free:

BASIC

- 8 HOUR COURSE

- • Building a fully integrated 3-statement model with detailed supporting schedules

- • Visual explanations and examples of key concepts (e.g., D&A, goodwill, circularity)

- • Tips on troubleshooting your model when accounts don’t balance

- • Tips on how to make reasonable and defensible forecast assumptions

PLUS

- 10 HOUR COURSE

- • Building a fully integrated 3-statement model with detailed supporting schedules

- • Visual explanations and examples of key concepts (e.g., D&A, goodwill, circularity)

- • Tips on troubleshooting your model when accounts don’t balance

- • Tips on how to make reasonable and defensible forecast assumptions

- • Detailed explanations of DCF concepts (unlevered vs. levered cash flow, terminal value, WACC, CAPM)

- • Building a DCF analysis using both perpetuity growth and EBITDA multiple methods

PRO

- 12 HOUR COURSE

- • Building a fully integrated 3-statement model with detailed supporting schedules

- • Visual explanations and examples of key concepts (e.g., D&A, goodwill, circularity)

- • Tips on troubleshooting your model when accounts don’t balance

- • Tips on how to make reasonable and defensible forecast assumptions

- • Detailed explanations of DCF concepts (unlevered vs. levered cash flow, terminal value, WACC, CAPM)

- • Building a DCF analysis using both perpetuity growth and EBITDA multiple methods

- • Overview of core financial modeling concepts and theory

- • Building a simplified integrated 3-statement model of a lemonade stand business

- • Access to Google Spreadsheet of the simplified 3-statement lemonade stand model

- • Using Excel like a boss: mini-course with video demos of key Excel shortcuts