Watch our training videos.

Crush your LBO modeling interviews.

(Even if you don’t have a Goldman Sachs pedigree.)

Don’t want to read it all? Jump straight down to our LBO training video plans immediately.

If you worked at Goldman, you can stop reading. This ain’t for you.

HOW I HACKED MY WAY INTO PRIVATE EQUITY…

A few years ago, I was thinking to myself “Dude, WTF” as I sat in a new-hire training session at Huntsman Gay Global Capital, the private equity firm spun out of Bain Capital that I worked at as an investment associate after leaving consulting.

I had no formal finance education and no finance work experience before HGGC. I had just left a two-year stint at McKinsey.

Before that, I had absolutely no business experience at all. I had opened Excel literally maybe TWICE in my life before McKinsey. Income statements? Cost of capital? All that s*** was new to me.

I graduated from law school(!) of all places, after studying history at a state college.

McKinsey was awesome and I learned a ton. But after 2 years, it was getting repetitive. The travel was wearing on me. So were the 70-hour work weeks. My first year in consulting, I traveled four days a week for an entire YEAR.

At first, it felt pretty sweet. Jetting around on someone else’s dime. Staying in fancy hotels (at least fancier than I normally stayed in). But after a while, it started to suck.

Waking up every Monday morning at 4 am.

Getting home every Thursday after midnight.

Delays.

TSA lines.

Overcrowded cabins.

I was doing strategy and organization studies at McKinsey. They started to all feel similar after a while: interviewing clients, doing data analyses, refining strategy recommendations, making pretty PowerPoint slides.

I wanted to move somewhere with better lifestyle or compensation (or both).

A lot of McKinsey analysts went to private equity after a couple years. There was an informal analyst alumni mailing list where they traded interview tips and PE firm gossip. I heard that investment banking emails about private equity recruiting got forwarded around there, too.

But I was an associate and associates didn’t have any of those resources.

I strongly wanted to move into finance, because that’s where you could make a LOT of money.

But there was no track for associates into private equity. Especially with my background.

I realized that a huge hurdle to getting PE firms and headhunters to take me seriously was my lack of technical finance knowledge.

I didn’t have a network of buddies at Goldman and Morgan who could hook me up with practice models and teach me the basics.

But I was insanely determined to get into private equity.

I would have to learn ALL the technical finance skills I needed on my own.

AND craft my interview pitch.

AND somehow learn how to “think like an investor” to convince PE interviewers I had the chops.

AND I had to do it all in just a couple months. It was already November; PE recruiting would be in peak season in just a couple months. By February, it would all be over.

Pulling this off was a little bit of luck, and a lot of BUSTING MY ASS.

I stayed up until 2 am, 3 am, 4 am most nights, for weeks, poring over LBO explanations on the Internet, reading CFA books, and studying Excel models I found on my own. I pestered people at work to ask them about corporate finance concepts in bite-sized chunks — never long enough to be annoying — and then I went home and tried to put all the pieces together.

Eventually, I crafted a half-decent interview pitch, knew the basic patterns to look for, and could model reasonably sophisticated LBOs in Excel within an hour or two.

It paid off. I recruited and interviewed with maybe half a dozen PE shops and was offered a generalist investment associate position with HGGC in California — solid firm, solid team.

But it was a lot of GRINDING to get there.

Man, just thinking about if I had to go through all that again, I already have visions of this:

There had to be a better way for interview candidates (not from Goldman) than to suffer through this kind of pain.

I would find that better way in my new-hire training session at HGGC.

WHY ANY SUFFICIENTLY HARD-WORKING CANDIDATE CAN SUCCESSFULLY BREAK INTO PRIVATE EQUITY

Did you know most applicants that break into private equity do NOT come from elite “bulge bracket” Wall Street banks?

They sure as hell do NOT all come from Goldman or Morgan.

Why? Let’s think about it.

- According to the Private Equity Growth Capital Council, there are about 4,000 private equity firms based in the US alone. (This doesn’t count international firms.)

- These PE firms collectively own 13,000 companies headquartered in the US that employ 11 million employees.

- The size of the entire US labor force is 150 million according to the Bureau of Labor Statistics, which means more than 7 percent of all US workers are employed by a PE-owned company.

- With that much “coverage” over the US economy, it’s no surprise there are about $115 billion in private equity investments made EVERY SINGLE QUARTER.

- On top of that, PE funds replenish and raise $30-40 billion in fresh capital every quarter.

- And they still have in their coffers $450-500 billion in dry powder just waiting to be invested.

With this many firms and dry powder needing to be invested, firms cannot possibly find all the analyst / associate talent they need simply by recruiting from top Wall Street banks.

Sure, the most prestigious jobs at KKR, Blackstone, Bain, and Carlyle will always be ultra-competitive, and plenty of Goldman and Morgan candidates will compete for those jobs.

But there are s*** tons of other firms that are (1) highly respected, AND (2) produce great returns, AND (3) compensate their investment associates handsomely, I’m talking $200,000, $300,000, even $400,000 in some cases.

HGGC was a spinout of Bain Capital, but it wasn’t a mega PE firm. It was still pretty good.

It won Private Equity Firm of the Year.

In fact, by definition there are a thousand “top-quartile” firms among all US-based PE firms.

Plus, there are PE firms at every stage of the investing cycle: seed-stage, early-stage, venture, growth, late-stage, and buyouts.

A 23-year-old Goldman analyst may have detailed knowledge of how to model credit agreements, or run a DCF, or even build an LBO for a multi-billion dollar public company.

But they’re just going to have limited knowledge of early-stage venture investing. Or mid-market buyouts.

Most PE transactions are not the kind that will land on the front page of the Wall Street Journal.

The average exit size is around $500M, which just isn’t the conglomerate type of deal Goldman works on.

On top of that, I can’t tell you how many PE deals have weird strings attached to them, that I’m pretty sure they don’t teach you how to model in investment banking.

Examples:

- The owner wants to make sure he and his brothers have the ability to keep a certain percent of the company after the transaction, but they want it structured using a weird combination of warrants and ratchets.

- The owner CEO wants to stay in power, and can block the transaction, but the PE firm would like to bring in a new CEO — how to handle this delicate situation?

- The owner wants to make sure the company keeps doing business with a supplier who is a long-time family friend, but the PE firm doesn’t think this is best for the company. How to structure this creatively?

- I could go on.

BUT YOU STILL NEED THE TECHNICAL FINANCE CHOPS TO COMPETE WITH THE BIG BOYS

In that new-hire training session at HGGC, they did something funny.

They trained us on how to model an LBO “the right way.”

Since all the HGGC founders were former Bain Capital MDs, they used the new-hire LBO training materials from Bain Capital and refined it for our firm:

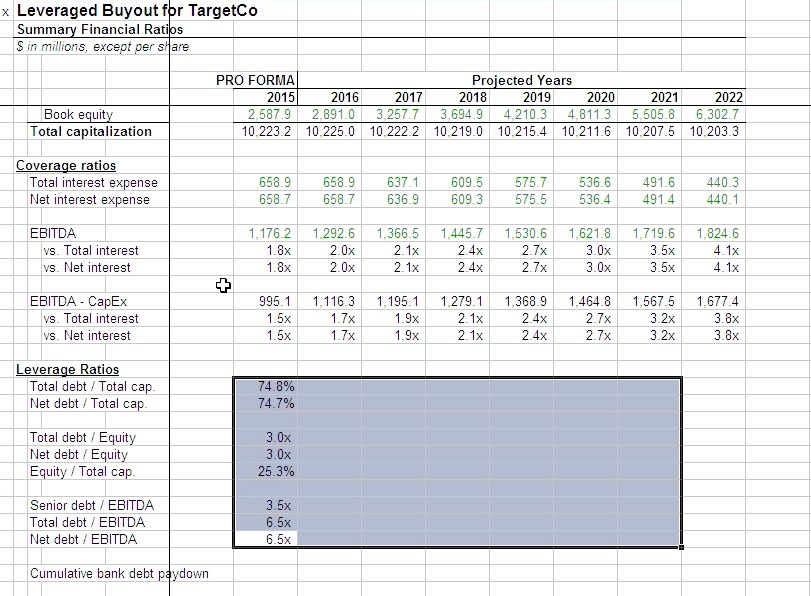

- They trained us on how to build a full-blown, complex LBO model in Excel

- How to think about LBO finance

- How to do “paper” LBOs conceptually

- Special regulations and rules that applies to LBOs

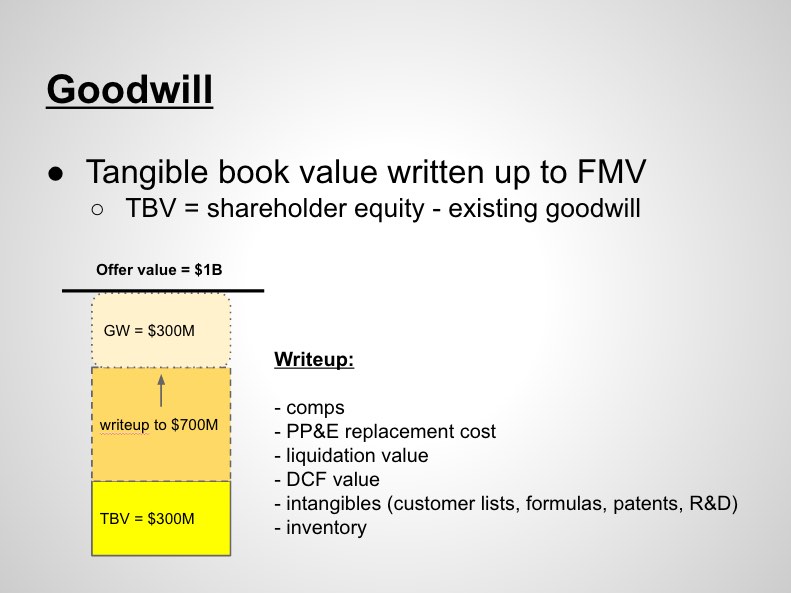

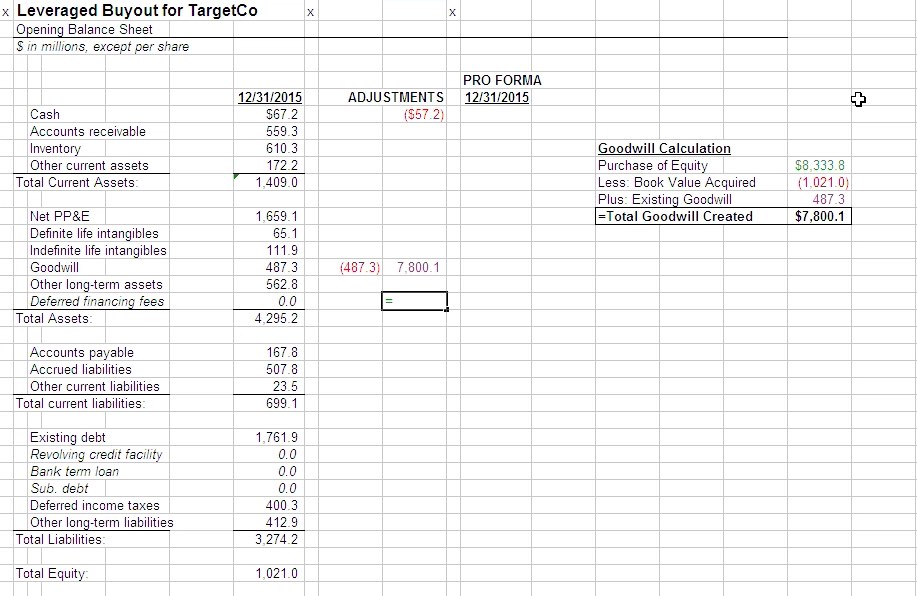

- How to think about tricky issues like Goodwill in LBOs

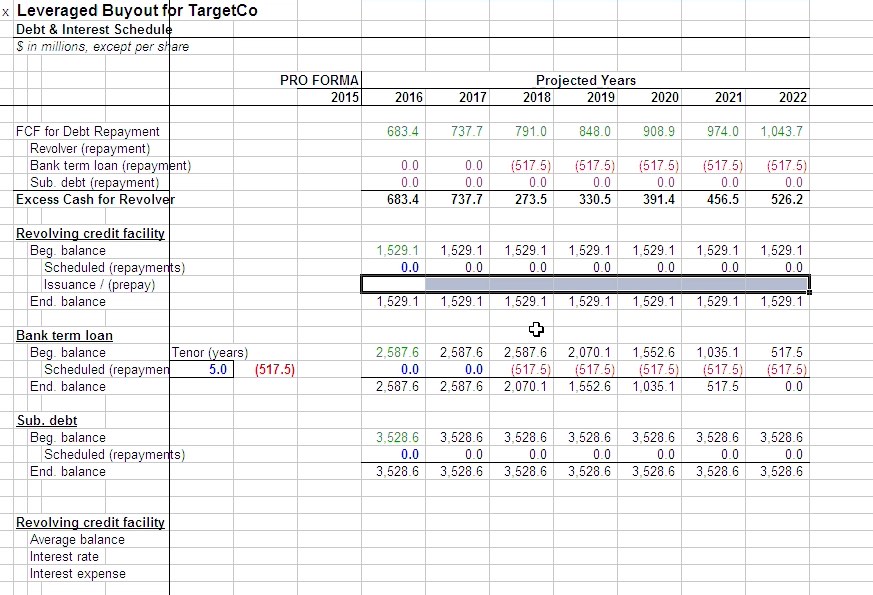

- How to think about debt tranches

And I was like, for real dude?

This is coming AFTER I’ve already joined the PE firm and proven that I know how to think about LBO basics?

This is the training I SHOULD have done ALL ALONG to prepare for my interviews!

Who knows, if I had known all the nuances and details, maybe I could have gotten into an even better PE firm.

This seared into my brain just how much technical finance knowledge plus process knowledge you as a candidate must nail down BEFORE you walk into your first interview.

Yet there isn’t a well-established process for training and prep as exists for investment banking or consulting.

It REALLY helps to have an insider’s understanding about what to expect.

About how to demonstrate knowledge and expertise.

About how to “cut corners” efficiently when you simply don’t have time to do fine-grained analysis in the interview.

You have to make a hundred little judgment calls in the interview room about how to structure your answers, or simplify your model, or frame a PowerPoint slide.

Without a good understanding of what PE interviewers are actually looking for and how they’re evaluating you, you’re pretty much just guessing. And setting yourself up for underperformance.

That’s where this course comes in.

I will teach you how to CRUSH your LBO modeling test.

I will teach you the same tactics and details you learn in new-hire training on how to model LBOs the “right way.”

But I will focus you specifically on tactical skills to help you nail the LBO modeling TEST.

It’s geared toward candidates who have little or no previous PE experience. But it’s also good for experienced candidates who want an LBO modeling refresher.

Typical Wall Street LBO modeling classes charge thousands to enroll. That’s because they’re live seminars, so they have to pay an instructor, book a hotel conference room, etc.

But with our step-by-step training videos — at a fraction of the price — you can learn at your own pace, watch our LBO modeling examples as many times as you need, and develop a keen understanding of how to model private equity transactions.

SO WHAT DO I ACTUALLY GET WHEN I BUY YOUR COURSE?

We structure our training videos into bite-sized Excel screencasts showing you exactly how to break apart the modeling test using 2 examples:

- A full-blown half-day integrated model with detailed supporting schedules

- A rapid 60-minute two-sheet model

That will equip you to face down any modeling test format you get: whether it’s a full day or just one hour.

For Plus and Pro customers, we’ll also show you how to quickly and efficiently draft an investment thesis presentation in PowerPoint.

It purposely doesn’t have the polish of a client presentation, but that’s because when you’re under time pressure, you’re simply trying to get your ideas across on paper, and make your recommendation well-structured.

We teach you how to do that.

For Plus and Pro customers, we also teach you:

- All the shortcuts for modeling very efficiently in Excel (using no custom macros or plugins, because you won’t have those in the interview room)

- How to think intuitively about the mechanics of LBO finance using paper LBO examples

Finally, for Pro customers, you will also get our PE interview guide e-book ($99 value) for just $10 extra bucks. (Check out the table of contents using the link for a preview of what’s inside.)

So now, imagine your PE interviewer walking in and dropping a packet on the table, saying: “Hey, our bankers just sent us this Investment Memorandum for Acme Corp. Can you take a couple hours and let me know whether we should invest?”

With the knowledge I’m about to teach you — which is exactly the knowledge I wish I had when I interviewed — when you walk into an interview situation like this, you will have a systematic approach and framework for tackling — and CRUSHING — the LBO modeling test.

HMM, BUT IS IT REALLY WORTH THE MONEY?

Well, on the one hand, our training videos range from $229 – $299. That’s definitely a lot.

But quite simply, the stakes for success or failure in your PE interviews are really freaking high.

Compensation for PE associates is very lucrative — often $200,000 – $350,000 or more annually. That’s 4x – 7x the national household median income by the time you are 24 or 25 years old.

Once you’ve been in the job several years, your pay can quickly rise to half million or more per year.

That means your investment in yourself through purchasing our training videos can pay off many hundreds of times over in your first year on the job alone.

And it only goes up when you think about your earnings over time — after getting your foot in the door.

Also remember that you typically only get ONE SHOT interviewing for private equity firms. If you don’t land a PE job in the year your “class” is being recruited, it’s really hard to come back in a subsequent year and re-recruit / interview again.

By then, there is a new class of PE recruits flooding the market from consulting firms, banks, accounting firms, and corporate strategy departments. PE headhunters will be focusing their time on this new class and it’s super hard to get their attention when they’re preoccupied with fresh candidates coming from these 2-year rotational programs.

That makes the risk of not being totally prepared for your interviews very, very costly, because it could mean missing the chance of a lifetime to enter private equity — and the big paydays that come with it.

How much is it worth not being totally prepared and potentially losing the opportunity to break into the profession?

By contrast, how much is it worth it to invest in yourself by purchasing the training videos and potentially winning a lucrative private equity job?

With your new PE salary, you’d earn back your investment in the training videos in just one DAY on the job — with more than enough left over to buy your friends beer to celebrate!

WHAT HAVE OTHER CUSTOMERS SAID ABOUT YOUR COURSE?

– Consultant at Bain & Company

“I bought the LBO course to prepare for my interviews with private equity firms. I did not have a background in finance and wanted to learn, in an efficient way, everything needed to succeed at interviews. The LBO videos are the best materials I have come across to prepare for private equity interviews. They provide a very good understanding of LBO mechanics and are very easy to follow. Especially helpful are the two versions of LBO modeling tests provided: to help you prepare for both a full-blown 3-statement + supporting schedules modeling test, or a rapid 45-minute LBO modeling test.”

– Case Team Leader at Bain & Company, MBA graduate from INSEAD

“Although I’ve been in finance for a while and understand accounting, I work at a FIG-focused firm where all of our investments are in balance sheet heavy businesses, so the debt is always asset-driven rather than cash flow-driven. The concepts of EBITDA and EV don’t really exist in our world. I had no familiarity with LBO models until about 5 days before my case study with one of the big buyout shops, and I slammed your videos in the lead-up. The case study ended up going great, and the headhunter said afterwards she had almost never received such good feedback. Thought you’d be pleased to hear that! I had to bite my tongue at the end of the interview not to say, ‘I only learned this a few days ago!’ I’d definitely recommend your LBO course for anyone needing a crash course before their interview.”

– Investment Director at mid-market European private equity firm

“I bought the PE guide and training videos to prepare for my 2nd-round interview with a private equity firm, which was to build an LBO model in 3 hours followed by a 1-hour investment presentation. I had no idea what to expect, but I watched the videos carefully and the techniques and theory were extremely clearly explained. So even though the investment case I was tested on in my interview was totally different, I understood the process enough that I felt comfortable applying the techniques I had learned. Thankfully, I passed the interview and received an offer! I never would have made it if I didn’t have the videos and the PE guide. The videos were very easy to understand, even for someone without a corporate finance background. Thanks so much for the awesome training materials. I appreciated them very much!”

– Analyst at a multi-billion dollar private equity firm, former Senior Associate at a “Big 4” accounting firm

“In my opinion your training videos and book have the most complete and technical PE interviewing information that I’ve seen to date — all in one place, which is a huge value for people. Wish I would’ve come across it two years ago.”

– Senior Consultant at Bain & Company, graduate of top-5 MBA program

“The video tutorial is very comprehensive, informative, and well-structured. It focuses on practical technical skills. It also sheds light on how PE professionals analyze financial transactions and teaches you step by step how to build LBO models quickly, efficiently, and accurately. The guide that comes with it also shares a lot of insights on what the interviewers look for in candidates, from an insider’s point of view. It benefited me greatly in my preparation as it showed me how to demonstrate my technical financial skills in modeling and also how to present myself as an all-rounded candidate. Thank you!!”

– Current associate at a multi-billion dollar private equity firm in Tokyo, former analyst at a Bulge Bracket investment bank in Tokyo

“Andrew’s LBO modeling tutorial videos and PE interview guide were of immense help as a refresher course in my preparation for investment analyst roles on the buy side. The best thing about the course is that it covers all the necessary details in short videos. This saves a lot of time and helps you to feel confident about your preparation since actual interviews may go in various directions based on the interviewer. I would highly recommend this course for anyone who is willing to put in the effort into cracking the PE interview process as it definitely helped me land my buy-side job.”

– Investment Analyst, Family Office, CFA Charterholder

OK, I’M IN! WHAT HAPPENS WHEN I BUY YOUR COURSE?

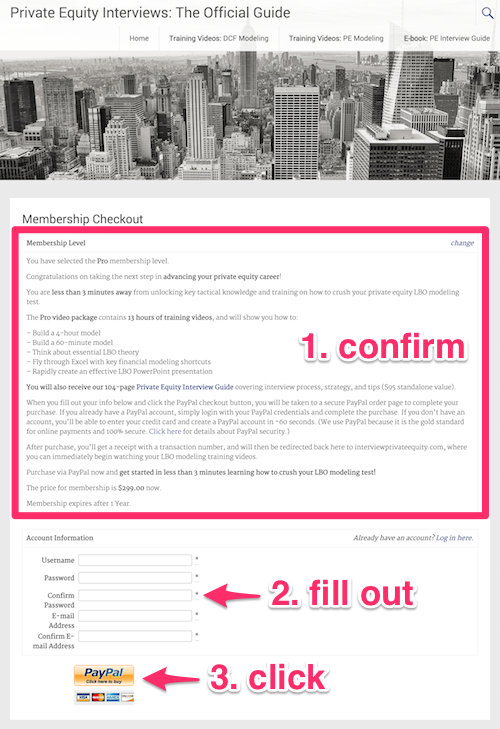

First, you’ll scroll down to the bottom and choose the plan you want: Basic, Plus, or Pro.

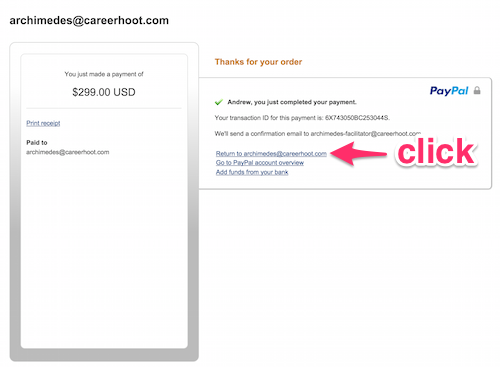

After completing your purchase, click “Return to [email protected]” (which FYI is the domain account I use to run this website).

Finally, click the “Get Started” button on the purchase confirmation page, and you’ll get instant access to the library of training videos you purchased.

All of our training video packages grant access to all videos in that package for 1 full year.

Still not sure? You can check out our first LBO training video here:

Here are our plans:

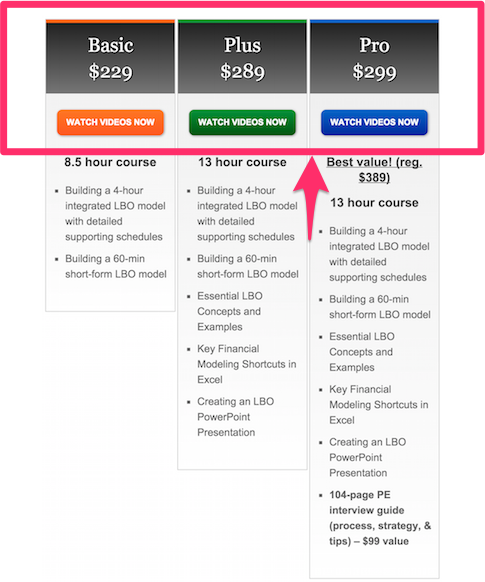

Basic

$229

8.5 hour course

- Building a 4-hour integrated LBO model with detailed supporting schedules

- Building a 60-min short-form LBO model

Plus

$289

13 hour course

- Building a 4-hour integrated LBO model with detailed supporting schedules

- Building a 60-min short-form LBO model

- Essential LBO Concepts and Examples

- Key Financial Modeling Shortcuts in Excel

- Creating an LBO PowerPoint Presentation

Pro

$299

Best value! (reg. $389)

13 hour course

- Building a 4-hour integrated LBO model with detailed supporting schedules

- Building a 60-min short-form LBO model

- Essential LBO Concepts and Examples

- Key Financial Modeling Shortcuts in Excel

- Creating an LBO PowerPoint Presentation

- 104-page PE interview guide (process, strategy, & tips) – $99 value