Are you planning to interview for private equity jobs in the near future and are nervous or anxious about the LBO modeling test during the interview?

Private equity firms typically require candidates to take a financial modeling test as part of the interview process, where candidates are asked to build a working LBO model under time pressure, analyzing a company / potential investment opportunity.

The stakes are high, because compensation for private equity associate positions can be very lucrative — often ranging from $200,000 – $350,000 or more annually. That’s 4 – 7x the national household median income by the time you are 24 or 25 years old.

The good news is nailing the LBO modeling test is a highly trainable skill. Unfortunately, many Wall Street LBO modeling courses cost thousands of dollars for a couple days of classroom instruction.

But our Private Equity Training Videos provide the same hands-on, step-by-step training — at a fraction of the price — on how to build both complex and rapid-form LBO models that the live classes offer. Moreover, there’s no risk of “falling behind” in our course, because you can watch and learn at your own pace and review our examples as many times as you need to develop a strong understanding of how to model PE transactions.

Our LBO modeling course provides tactical knowledge and training on how to nail your LBO modeling test, making it the perfect solution for candidates who have no previous private equity experience, as well as candidates who are looking for a PE modeling refresher.

Our videos will show you how to:

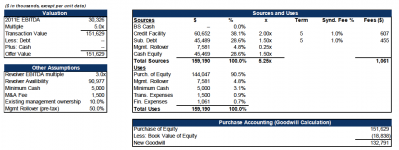

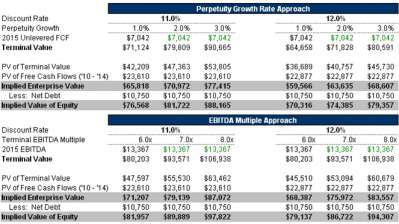

- Think intuitively about the mechanics of LBO finance

- Model leveraged buyouts efficiently in Excel

- Communicate your results effectively with a PowerPoint presentation

All of our training video packages grant you access to all the videos in that package for 1 full year.

Check out our course syllabus below and watch the first training video here!

We also offer LBO + DCF discount combo packages.